In recent years, our social environment has continued to change on a global scale, and addressing social issues, such as initiatives based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), has become an important item on the management agenda. We regard addressing climate change as a material issue and have made carbon neutrality a pillar of our business activities in our new Medium-Term Business Plan (FY2023–FY2025). We will continue to strategically prioritize markets linked to carbon neutrality, such as electric vehicle (EV), fuel cell vehicle (FCV), automated driving, and semiconductor-related markets, and will focus on recruitment, education, and sales for these markets. Moreover, by having our engineers participate in carbon neutrality-related technology development projects such as these, we will advance the development of these technologies and support their widespread use in the market, thereby contributing to the realization of carbon neutrality.

In July 2022, we announced our support for the recommendations from the TCFD. We will disclose information in a manner consistent with the recommendations published by the TCFD, with the aim of achieving a sustainable society.

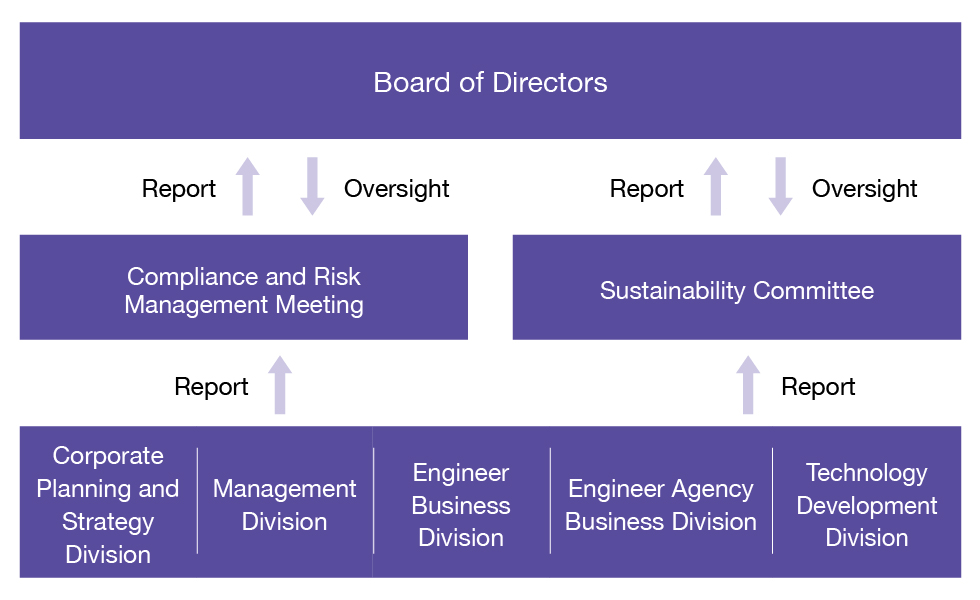

As we have rated climate change as a high-priority issue, we have established the Sustainability Committee as a special committee for discussing sustainability-related issues including climate change. This Committee is established directly under the Board of Directors, and reports and submits the topics it discusses to the Board, which then deliberates and makes decisions on them. The content of such discussions will be disclosed externally and reflected in the Company’s management policies and various initiatives.

The Committee, chaired by the President and CEO, is composed mainly of Directors who are not members of the Audit and Supervisory Committee, Directors who are members of the Audit and Supervisory Committee, and division heads and managers, and is held four times a year. The Committee promotes and manages the status of sustainability issues and initiatives, including those related to climate change.

The topics deliberated in the Committee are reported to the Board of Directors. The Board then deliberates and adopts the resolutions on important risks and opportunities related to climate change, gives instructions on how to deal with them, and supervises the progress of such initiatives.

As our social environment continues to change on a global scale, we believe that dealing with social issues, such as initiatives based on the recommendations from TCFD, is an important managerial agenda.

We will strive to build an internal system of recruitment, training, and sales with carbon neutrality as a main pillar of our business activities.

In April 2022, our Sustainability Committee conducted a climate change scenario analysis based on the recommendations from the TCFD. For this analysis, we identified key risks and opportunities related to climate change and conducted a qualitative evaluation of their impact. Our first scenario analysis, which covered our main business area of engineer dispatching, used two scenarios (a 4°C scenario and a combined 1.5°C and 2°C scenarios) to examine the impact of climate change in the year 2030.We extracted risks and opportunities, and the degree of impact on our business activities was evaluated on a three-point scale of large, medium, and small.

Regarding the financial impact of climate change on our business, we consider the risk of climate change to be low, as we are primarily engaged in engineer dispatching services in Japan and do not need to own production facilities or other equipment.

<Evaluation> Based on financial impact –

Large: Impact is clearly large;

Medium: Degree of impact is unknown;

Small: Impact is clearly small;

Gray: Assumed to have no impact

At the Compliance and Risk Management Meeting, we identify risks that need to be addressed among various risks such as climate change, set priorities for responding to such risks, and manage progress on an ongoing basis. The topics discussed in the Meeting are reported and submitted to the Board of Directors, which then deliberates and makes decisions on such topics.

We calculate our greenhouse gas (GHG) emissions as shown below.

Our goal for FY2051 is to achieve net zero GHG emissions.

Unit: tCO2

*Fiscal year ended January 31

Unit: tCO2