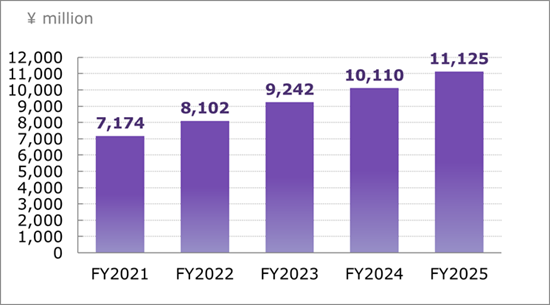

・ In the engineer dispatching business, due to an increasing number of engineers and the utilization rate remaining high, the number of operative personnel surpassed that of the previous year. In addition, the trend of engineer shortage and wage increases by companies pushed up the unit price for newly graduated engineers at their first assignments, and current engineers were rotated between clients to improve engineers’ work level. In turn, the unit price of engineers surpassed that of the previous year. In the contracting business, aggressive sales activities have led to an increasing number of engineers assigned to contracted projects. Furthermore, we shifted from engineer dispatching to contracting projects in response to client needs. In turn, the ratio of the contracting business to net sales became 11.6%. As a result of all this, net sales increased 10.0% year on year to ¥11,125 million.

・In the engineer dispatching business, due to an increasing number of engineers and the utilization rate remaining high, the number of operative personnel surpassed that of the previous year. In addition, the trend of engineer shortage and wage increases by companies pushed up the unit price for newly graduated engineers at their first assignments, and current engineers were rotated between clients to improve engineers’ work level. In turn, the unit price of engineers surpassed that of the previous year. In the contracting business, aggressive sales activities have led to an increasing number of engineers assigned to contracted projects. Furthermore, we shifted from engineer dispatching to contracting projects in response to client needs. In turn, the ratio of the contracting business to net sales became 11.6%. As a result of all this, net sales increased 10.0% year on year to ¥11,125 million.

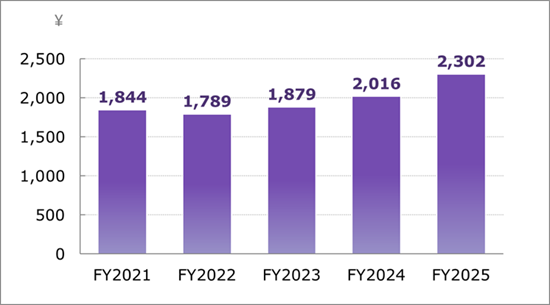

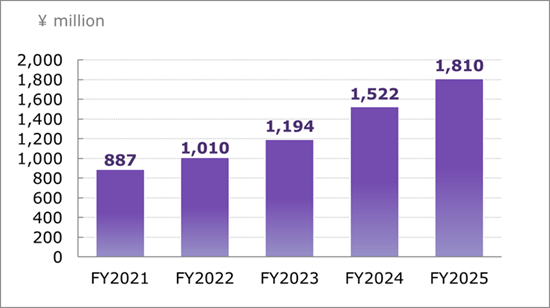

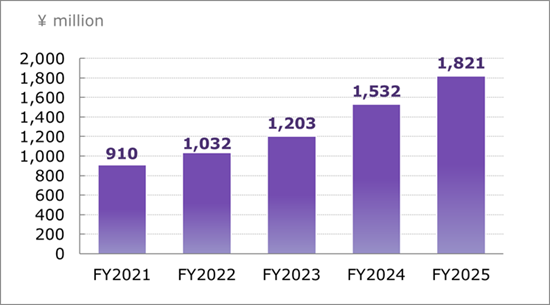

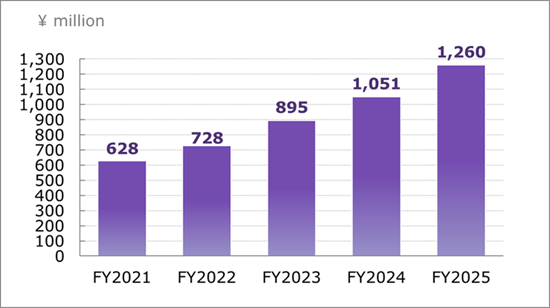

As a result of all this, operating profit increased 18.9% year on year to ¥1,810 million. Ordinary profit increased 18.9% year on year to ¥1,821 million. Profit increased 19.8% year on year to ¥1,260 million.

Up 10.0% year-on-year

◾️Number of engineers increased

◾️Utilization rate remained high

↓

◾️Number of operative personnel increased

◾️Unit price of engineers rose

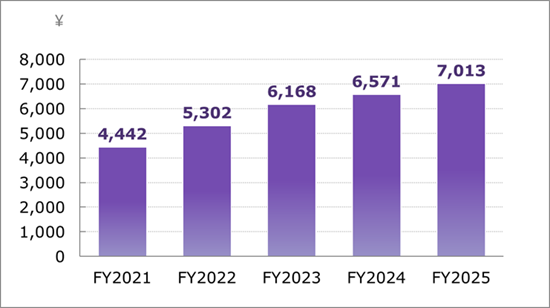

Up 6.7% year-on-year

Cost of sales increased as the number of engineers increased.

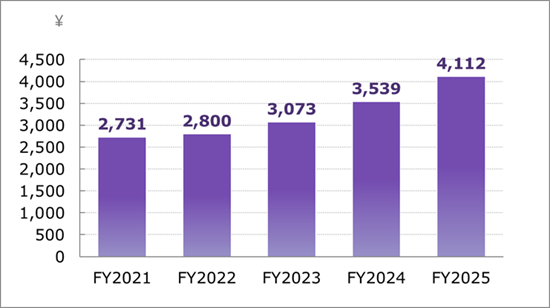

Up 16.2% year-on-year

◾️Whereas net sales increased by 10.0%, the cost of sales increased by no more than 6.7%. As a result, gross profit increased by a higher percentage than net sales.

Up 14.2% year-on-year

◾️Expenses were incurred from expanding the learning centers in East Japan (training facilities).

◾️TRecruitment-related investment expenses increased.

Up 18.9% year-on-year

◾️Whereas gross profit increased by 16.2%, SG&A expenses increased by no more than 14.2%. As a result, operating profit increased by a higher percentage than gross profit.

Up 18.9% year-on-year

◾️Non-operating income and non-operating expenses were about the same as those in the previous year. As a result, ordinary profit increased by around the same percentage as operating profit.

Up 19.8% year-on-year

◾️Record-high profit.

◾️As profit before tax and expenses remained steady, profit increased by a higher percentage than net sales.

*Fiscal year ended January 31

Unit: ¥ million

Data on major indicators is provided below as an Excel file for use in spreadsheet software.

Quarterly Financial Fact Book for Q4 (FY2025) [Excel 21.9KB]

Financial Fact Book for full year (FY2025) [Excel 27.7KB]