Establishing a stable financial base and continuously improving enterprise value

Chief Financial Officer (CFO)

HARIGAE Tomonori

FY2025 saw the company achieve record-high performance of ¥11,125 million in net sales (up 10.0% from the previous year) due to increased demand from automobile-related manufacturers, makers of semiconductor manufacturing equipment, and other major customers, and a record profit of ¥1,260 million (up 19.8% from the previous year.) As a result, operating cash flow saw a steady increase to ¥1,126 million and increase in free cash flow to ¥1,131 million. Additionally, earnings per share (EPS) reached ¥118.64, with a compound average growth rate (CAGR) of 20.0% over the three-year period starting from the fiscal year ending January 31, 2022.

For the Medium-Term Business Plan starting in the fiscal year ending January 31, 2026, we have set the following business targets: net sales of ¥18.7 billion; an operating margin of 16.0%; employment of over 2,100 engineers; and a return on equity (ROE) of over 20%.

In the engineer dispatching business, our main business, net sales are calculated using the number of operative personnel (number of engineers × utilization rate) × unit price of engineers × total work person-hours. Cost of sales is calculated using labor costs, etc. for engineers assigned to our clients in engineer dispatching; and labor costs for engineers, outsourcing costs paid to partner companies, etc. in contracting business. Finally, selling, general and administrative (SG&A) expenses include labor costs for engineers undergoing in-house training (standby status) and labor costs for other staffers. Therefore, our key management indicators are “number of engineers,” “utilization rate,” and “unit price of engineers.”

To improve the gross margins in the future, it is essential to increase the unit price per engineer. We aim to increase the unit price of engineers by enhancing their added value, such as through strengthening our training programs and offering extensive career support. In addition, by improving management efficiency, we will improve the operating margin thereby minimizing the addition of administrative staff associated with the increase in engineers and suppressing any increase in the SG&A expense ratio.

We will continue to work toward realizing our Medium-Term Business Plan targets of increasing the number of engineers to 2,100 and maintaining a high utilization rate, unit price of engineers, and total work person-hours. By doing so, we will endeavor to grow net sales to ¥18.7 billion, and through appropriate management of the recruitment cost ratio relative to net sales, achieve an operating margin of 16.0%.

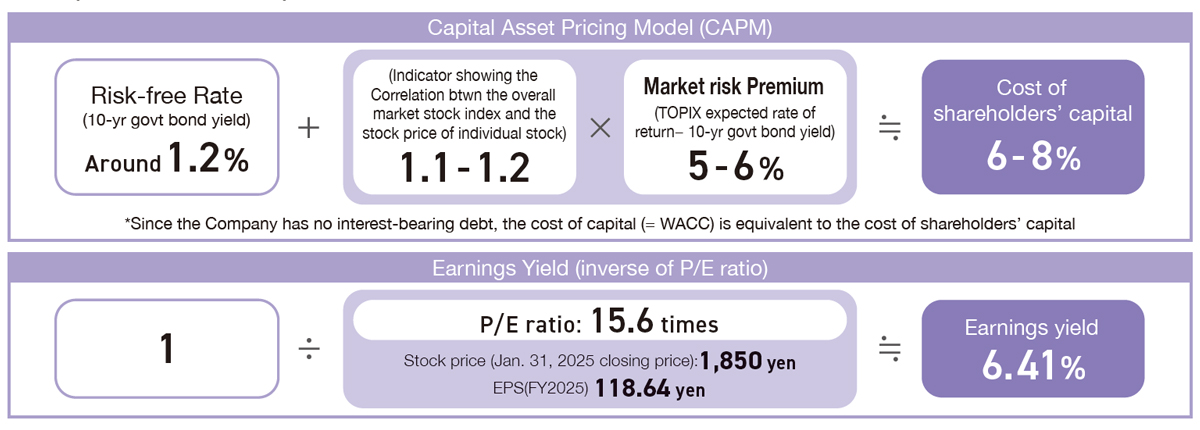

Given that the Company has no borrowings and has a high equity ratio, we attach importance to the cost of shareholders’ capital. We are mindful to keep the cost of shareholders’ equity at approximately 6-8% in managing our business. Our ROE target was to reach more than 20%, and we achieved a capital efficiency of 28.1% in FY2025, exceeding the cost of shareholders’ capital. Going forward, we will continue to increase profit, the numerator in the ROE equation. With regard to the denominator, equity, we intend to return profits to our shareholders and invest in growth in line with our cash allocation policy while considering the balance with retained earnings.

Assumptions for Cost of Capital

In order to achieve sustainable growth, we will strive to secure stable cash flows and efficient capital allocation. We aim to hold approximately three months’ worth of monthly net sales as cash on hand, and to reserve any surplus funds for future growth opportunities. Regarding cash flow within the Medium-Term Business Plan, we expect cash inflow from operating activities of ¥8.5 billion, cash outflow of ¥3.0 billion from growth investment*, shareholder returns of ¥5.0 billion, and liquidity on hand of ¥500 million.

*M&A, alliances, facility investment (expansion of training hubs, etc.), human capital investment (education, health and productivity management), stronger business promotion (recruitment, IT/DX investment)

Cash Allocation in the Medium-Term Business Plan

(FY2026 to FY2030)

Cash Inflow

Cash Flows from Operating Activities (Medium-Term Business Plan cumulative)

Cash Outflow

|

Growth Investment¥3.0billion |

|

|

Shareholder Returns¥5.0billion |

|

|

On-hand Liquidity¥0.5billion

|

|

In terms of profit distribution, we comprehensively consider future business developments, earnings, the management environment, as well as the strengthening of our management foundations, and positions the supply of stable dividends to our shareholders as top-priority management tasks. Accordingly, we have agreed to consider a payout ratio with a base of 50%. In addition, our basic approach is to continue to grow our profit this year, ensuring that the dividend remains at least at the same amount as the previous year and continues to increase. The Total Shareholder Return (TSR) has been as follows.

| FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|---|

| *TSR (Total Shareholder Return) (%) | 107.3 | 112.2 | 134.9 | 291.0 | 257.2 |

| Comparison index: TOPIX total return index (%) | 110.0 | 117.7 | 126.0 | 166.9 | 186.7 |

As a company listed on the Prime Market of the Tokyo Stock Exchange, Artner is committed to managing and disclosing our management indicators appropriately, striving for transparent and trustworthy financial management to earn and maintain trust from our stakeholders. To this end, we consider it critical to focus on implementing IT and DX investments, upgrading our management systems and improving business processes, as well as executing proper management of our financial figures and contributing to the Board of Directors’ decision-making. We will continue to make efforts to improve our margins and capital efficiency, always conscious of generating cash, allocating cash, and returning value to our shareholders. Moreover, by differentiating ourselves from our competitors in financial management, we will aspire to achieve sustainable growth and increase our enterprise value.